Data Accuracy Assurance

Ensures your consumer information is accurate and verified, empowering you to take control of your financial records confidently.

Valid Compliance Verification

Confirms that all data access respects your consent and complies with relevant regulations to protect your privacy rights.

Timely Access Monitoring

Tracks when and how your data is accessed to prevent unauthorized use and supports prompt interventions when necessary.

Empowering Consumers with Verified Data Transparency

Explore key challenges in consumer report verification and how our insights help protect your financial information with confidence.

Ensuring Access to Consumer Data

Understand how verifying consent and data access timing safeguards your personal credit information effectively.

Verifying Notice and Consent Processes

Learn how confirming proper notification and consent prevents unauthorized data use and builds trust.

Addressing Timing and Accuracy Challenges

Discover strategies to overcome delays and inaccuracies in consumer report handling for better protection.

Understanding Verifiable Consumer Reports

Discover how verifiable consumer reports empower you with transparent access to your financial data through clear, actionable steps.

Step One: Confirming Access

Begin by verifying that any data access notice and consent are valid to protect your consumer rights and privacy before proceeding.

Step Two: Verifying Notice, Consent and Timing

Review the timing and authenticity of notice and consent given, ensuring all notifications comply with regulations to maintain data integrity.

Step Three: Safeguarding Your Information

Complete the process by validating access legitimacy, securing your financial details against unauthorized use and ensuring transparency.

Understand Verifiable Consumer Reports

Explore how verified reports empower consumers to protect their data privacy.

Access Requirements

Learn the critical steps to verify lawful access to your financial information.

Verification Challenges

Investigate common issues faced when confirming notices and consent validity.

Timing and Transparency

Understand the importance of access timing in safeguarding your data.

Verifiable Consumer Reports Insights

Explore real experiences that demonstrate how verifiable reports protect your data and promote transparency.

Why Consumers Need This:

Whether you need credit for:

- your first home

- a second credit card

- investments

- a company car

- or simply peace of mind

You deserve a system that verifies the notices and access at every step.

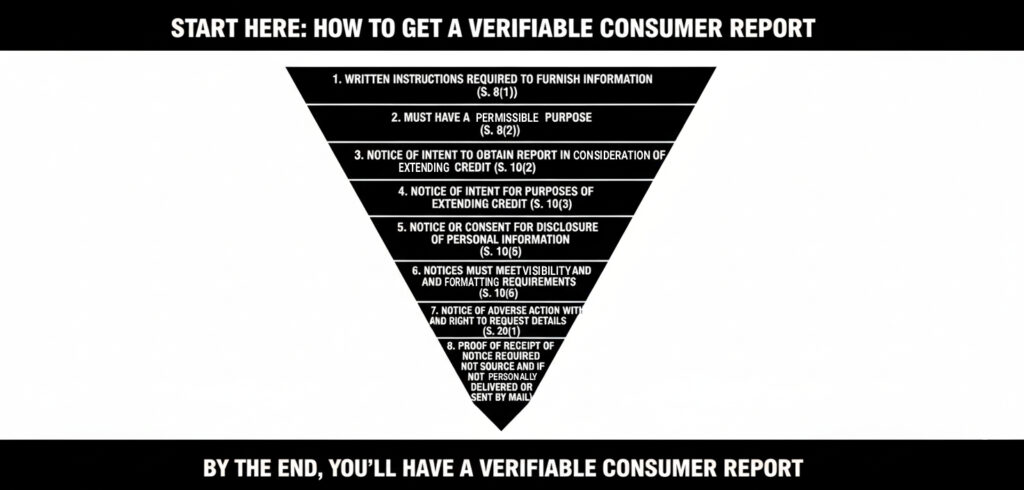

That’s why we built a funnel to create verifiable consumer reports

Every step is designed so consumers can:

- verify their notices

- verify their consent

- verify the timing

- verify their reports

Every step allows consumers to verify their reports.

‘ You have correctly pointed out that Section 10(6) of the Ontario Consumer Reporting Act requires

the notice to be “clearly set forth in bold type or underlined.’

Mogo Finance Technology Inc./Mogo Financial Inc.

E. Feller, Privacy Officer

‘ I

acknowledge that Home Trust only partially met this requirement in that the notice required by S. 10(2) was

presented in at least 10-point font; however, it was not bolded or underlined. I have taken note of this error and

have presented it to the business unit for immediate resolution.’

Home Trust

J. Liut, Privacy Officer